restaurant food tax in maryland

Maryland Food for. Sale of beer wine.

![]()

Restaurant Meals Program Maryland Department Of Human Services

The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages.

. On July 1 2011 the tax on the sale of alcoholic beverages increases from 6 to 9. Items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Individuals who do not have a permanent sales tax license are required to obtain a temporary license and collect a 6 percent or 9 percent sales and use tax for sales at various. Your FoodBeverage Tax Requirements Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction. As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the Citys.

Maine Prepared foods are taxable in Maine at the prepared food tax rate of 8. Sales and Use Tax. What This Means for Restaurants.

Depending on the type of business where youre doing business and other specific. Restaurant Food Tax In Maryland. Purchase breakfast lunch or dinner from participating restaurants by using your EBT card.

The Annapolis Maryland sales tax is 600. The tax must be separately calculated on sales of alcoholic beverages at the 9 rate and on sales of food non-alcoholic beverages and other merchandise at the 6 rate. Top 7 restaurants in Maryland.

Just outside Annapolis Jimmy Cantlers Riverside Inn has been described as. Jimmy Cantlers Riverside Inn Annapolis. All sales of food and beverage are subject to the tax except the following cases.

Groceries and prescription drugs are exempt from the Maryland sales tax Counties and cities. In the state of maryland sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Here are the 20 best restaurants in all of Maryland.

Chicago Restaurant Tax. You can read Maines guide to sales tax on prepared food here. Baltimore 1000 Lancaster St Baltimore MD 21202 United.

Coastal Wine Trail Credit. Business Tax Tip 5 How are Sale of Food Taxed in Maryland. A Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Your Meals Tax Restaurant Tax Requirements Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the. This page describes the taxability of. Maryland Sales and Use Tax Increases to 9.

The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6.

Wswa Commends Maryland S Extension Of Delivery Privileges For Bars Restaurants And Taverns Wswa

Sales Taxes In The United States Wikipedia

Curry Kabob In Columbia Md Indian Food Order And Delivery

Food Waste Could Tax Breaks New Labels And Ugly Produce Fix It

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Best Local Restaurants In Landover Hills Maryland Oct 2022 Restaurantji

Ask Laz Does Sales Tax Apply To Take Out Food That Depends Los Angeles Times

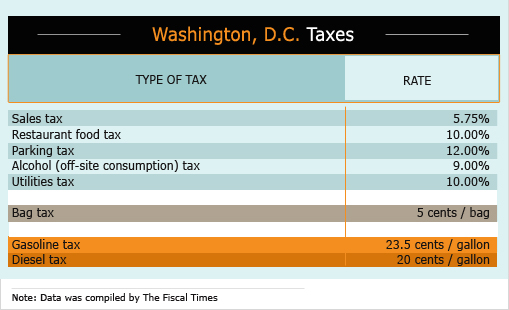

Do You Know What You Pay Every Day In Taxes The Fiscal Times

Ohio Sales Tax For Restaurants Sales Tax Helper

New York Sales Tax Basics For Restaurants Bars

Maryland Sales Tax Calculator And Local Rates 2021 Wise

Maryland Income Tax Calculator Smartasset

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Restaurant Association Of Maryland Columbia Md

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

Best Restaurants In Rockville Md A Comprehensive Guide

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities